Federal lending to raised knowledge have caught the eye out-of thread feedback providers. Into the March, Moody’s Buyers Services provided a magazine taking a look at the Community Business system and the Historically Black College or university and College Resource Resource Program. The fresh programs support institutions’ close-name monetary viability, predicated on Moody’s.

Into universities that will receive one financing — rather than the meet the requirements — its a touch of a production device, said Susan Fitzgerald, associate dealing with manager during the reviews department. They can see lower-rates funding financing than simply they might on personal business. Specific might not have even pricing-active capital selection.

The community Facilities system was projected getting $3.5 million in direct funds inside 2018, based on Fitzgerald. It provides other sorts of organizations one be eligible for the credit. Nevertheless, it suggests how large the program might. Into the 2014, the application form totaled about $step 1 billion.

Personal and you may people college or university loans increased significantly out of $73 million so you can $151 billion more than a decade, based on The brand new financialization off You.S. advanced schooling, a newsprint penned about diary Socio-Monetary Feedback inside the 2016. Financial obligation having private universities totaled $95 mil within the 2012, they located.

Wealthy establishments were likely to borrow for a variety of objectives, together with tuition and you may browse, this new report discover. They tended to borrow so you’re able to maximize its financial profits — it repaid less interest to their expense than simply they made to the the endowment property, so it’s cheaper so you can acquire having methods than it would be to pay for them try here out-of-pocket. Personal associations that were never as wealthy increasingly lent managed to acquire for the auxiliary and you can beginner functions, as well as student features such dormitories, cafeterias and athletics and recreation stores. You to probably indicated this new smaller rich establishments used debt in order to maximise the commercial earnings in the a quote to draw pupils who are willing to pay high tuition and you can costs.

Once Bethany School inside the Ohio launched their loan, a self-explained conservative had written a letter to your publisher in a local paper arguing that the regulators try offering income tax money one to might possibly be most readily useful invested somewhere else.

Because of extremely reasonable product prices, of numerous producers you can expect to better use You.S.D.A good. loan money than a private, for-funds school, the latest page told you.

Several HBCUs recently defaulted towards the funds within the program, and you may 30 percent regarding mortgage repayments was delinquent for the 2017, according to a research on the Authorities Accountability Workplace

Bethany leaders noticed that the latest page blogger improperly understood the newest college in terms of-funds and you can seemed to associate the mortgage having a grant. Bethany is truly an excellent nonprofit connected to the fresh new Evangelical Lutheran Church in america, and its particular management state it want to totally repay the fresh new currency they borrowed.

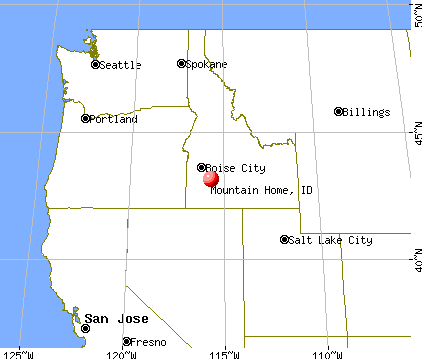

We needless to say could see that there are likely to be people nowadays who possess an issue with brand new USDA rendering it variety of loan, Jones said. Personally, i imagine it’s an excellent capital on behalf of the federal government to invest in regional, rural groups very often carry out be unable to come across money.

Any contrasting between your USDA credit so you can colleges and you will government financing to HBCUs might also punctual almost every other worries: about the chances that money would-be paid and about perhaps the credit is carried out in a way possible.

Even so, the latest fund portray a somewhat short slice of your total borrowing because of the colleges and universities

Some HBCUs have acquired complications accessing the HBCU Financial support Financial support Program, while some has actually battled to spend their funds not as much as it. Seven individual associations obtained deferments underneath the system the 2009 year.